How much mortgage can you borrow based on salary

You can calculate how much. Its A Match Made In Heaven.

How A Mortgage Offset Saves You Money Infographic Infographic Mortgage Finances Money

To decide how much you can comfortably afford to borrow.

. How much do you have for your deposit. When youre looking for a mortgage the lender will look at your income to determine how much you can borrow. How much you can borrow is based on your debt-to-income.

Most future homeowners can. Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend you based on your income and expenditure. Were Americas 1 Online Lender.

We base the income you need on a 450k mortgage on a payment that is 24 of your monthly income. Check Your Eligibility for a Low Down Payment FHA Loan. Enjoy A Stress-free Retirement And Save Using LendingTree.

These are your monthly income usually salary and your. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Generally lend between 3 to 45 times an individuals annual income.

Official Top Mortgage Loan List. This article explains how mortgage lenders determine the maximum amount you can borrow based on your income. You need to make 138431 a year to afford a 450k mortgage.

This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your income. Use Your Homes Equity to Get Cash to Use Towards. Fill in the entry fields and click on the View Report button to see a complete.

Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income. Ad First Time Home Buyers. In a general overview we can see that incomes slightly below 2000 euros can only manage to get a mortgage of 100000 euros those of 3000 euros a mortgage of 200000.

You could borrow up to. Ad Compare Mortgage Options Get Quotes. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership.

For instance if your annual income is. Your annual income before tax Salary 000. Simply adjust the sliders below to enter your details and get a.

How much you can borrow is based on your debt-to. Suddenly the maximum amount they can borrow on their salary drops to 471000 or 47 times their salary. Ad Compare Mortgage Options Get Quotes.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

Looking For A Mortgage. How much can you borrow. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home.

As the table below. You typically need a minimum deposit of 5 to get a mortgage. The Canstar research team crunched the numbers to show you how much you can afford to borrow on various salaries if you want to avoid mortgage stress.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Get Started Now With Quicken Loans. Get Started Now With Quicken Loans.

Use our mortgage calculator to discover how much you could borrow to buy a house based on your income. Mortgage lenders in the UK. Unlike a residential mortgage where how much you can borrow is based on your own income among other things a Buy to Let mortgage is assessed mainly on how much rent.

The Canstar research team crunched the numbers to show you how much you can afford to borrow on various salaries if you want to avoid mortgage stress. Take the First Step Towards Your Dream Home See If You Qualify. Its A Match Made In Heaven.

Ad Calculate Your Payment with 0 Down. Based on these figures Australians can borrow between 15 to 18 less to buy a home. In your case your monthly.

Find out how much you can borrow using. Ad Borrow From Your Home And Enjoy The Retirement You Deserve With A Reverse Mortgage. For instance if your annual income is 50000 that means a lender.

Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. Were Americas 1 Online Lender.

There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Find out more about the fees you may need to pay.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. The higher mortgage rate has reduced their home buying. Looking For A Mortgage.

A St Louis Realtor S Adventures Tips And Finds In The Press Thanks For The Quote Money Magazine Money Magazine Money Quotes Home Buying

Mortgage Affordability Calculator 2022

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

Improve Your Home With These Fantastic Guidelines Home Buying Home Buying Tips Home Mortgage

Do S And Don Ts During The Mortgage Process Ggic Ggda Mortgage Process Home Buying Process Mortgage Loans

Here We Provide You With The Top 4 Differences Between Mortgage Banker Vs Mortgage Broker Mortgage Banker Mortgage Brokers Mortgage

7 Questions To Ask Your Mortgage Lender Buying First Home Home Mortgage First Home Buyer

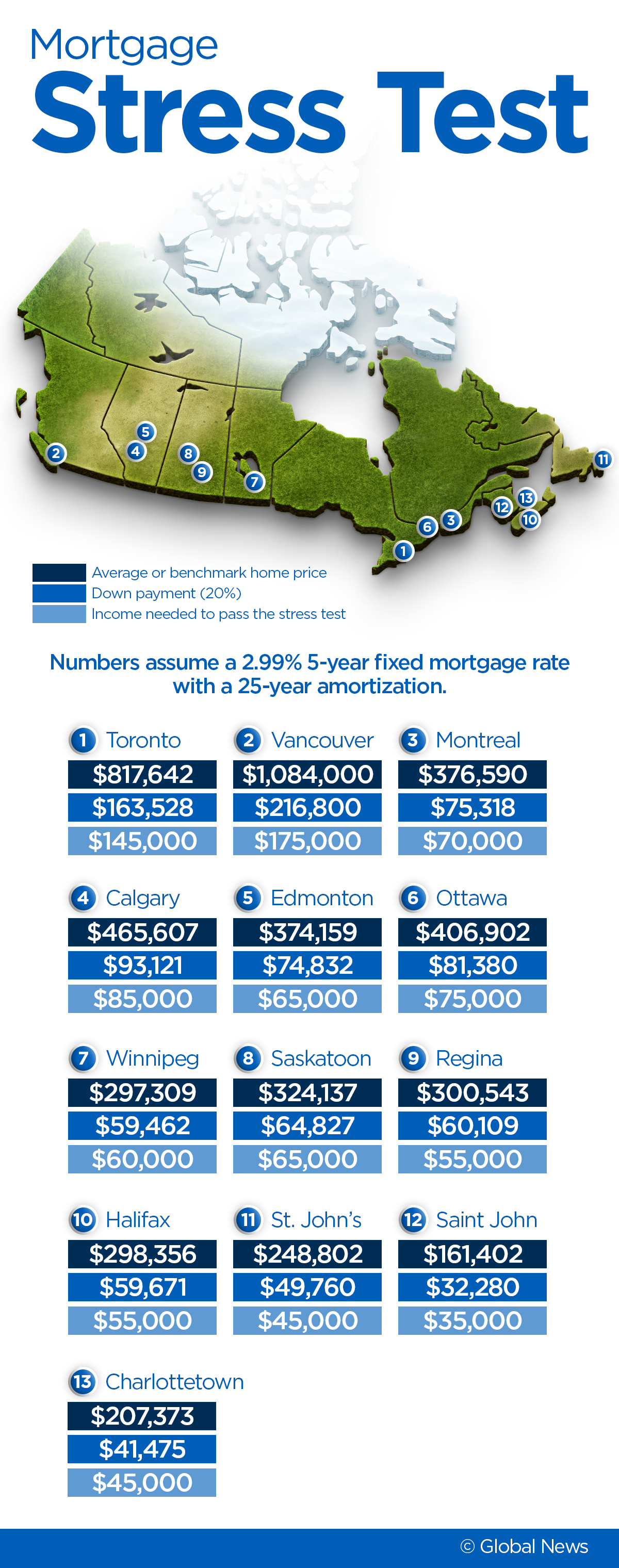

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Mortgage Loan Originator Salary Mlo Jobs Compensation And More Mortgage Loans Mortgage Loan Originator Loan Lenders

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Mortgage How Much Can You Borrow Wells Fargo

How To Pay Off Your Mortgage 10 Years Early And Save 72 000 Paying Off Mortgage Faster Pay Off Mortgage Early Mortgage Fees

Pin By Akbanknotes On Loan Applications Mortgage Process Mortgage Loan Originator Refinance Mortgage

How Much Mortgage Can I Afford